Shareholders Cant Forgive EML

Despite the board of directors immensely derisking the company by appointing a liquidator for PSCIL, the market is giving no additional value to $EML.AX after the stock initially climbed 30%. Brief reminder note: PSCIL is their unprofitable business which is responsible for decimating the stock since 2022 for regulatory uncompliance

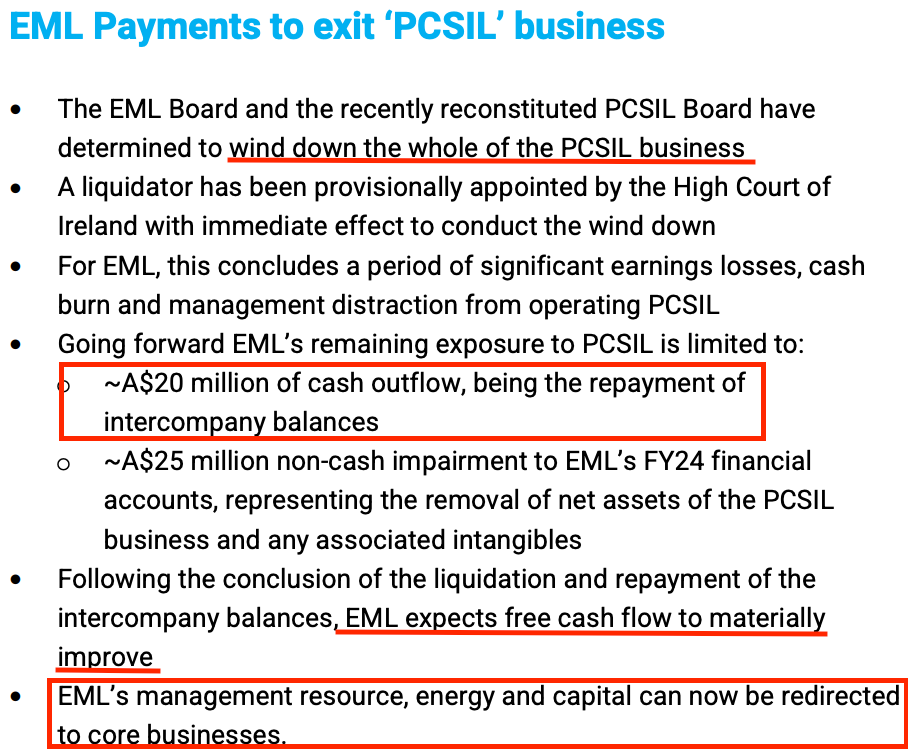

EML has appointed a liquidator for PSCIL and will transfer close to A$20m to wind down what has been the clear drag for the stock since 2022.

The board also reaffirmed that the strategic review is not complete yet and will keep resolving loss making entities. It is likely the still unprofitable Sentenial will be sold in some months. There is clear interest from buyers and intentions from the board.

Given the stock is trading so poorly despite tremendously good news, I think it is likely the board could consider selling all the company, specially if Connor Haley is leading the board and PSCIL is now being exited. This problematic subsidiary made the company uninvestable for any acquirer in the past.

The logic for selling the company after a hypothetical sale of Sentenial is very compelling. If the stock still trades bellow 90c in such a case, the board would get a clear message that the market will not pay what the the core business is worth, at least until PSCIL is fully liquidated and the strong performance of the core business shows.

This is one of the most compelling ideas in my portfolio. I am considering increasing my already significant position as the stock trades close to 80c.

A 10-day Holding: OreCorp

I bought shares in $ORR.AX about 3 weeks ago and closed my position this week for a ~10% return. It is still interesting.

OreCorp is a very small gold explorer that owns a potentially very attractive mine: Nyanzaga in Tanzania. The company never intended to develop the mine themselves given their undercapitalized nature and instead would partner or sell their precious asset. The mine requires $474m in initial investment compared to the A$200m market cap for the company at the time. Thereafter $ORR.AX agreed with through a scheme to sell all the remaining sahres to Chinese miner Silvercorp, who is a questionable acquirer and already owned 15% of shares.

The bid at the time was valued at 60c with a 2/3 cash component. SVM trades in Canada so OreCorp would get a Canadian listing. Swings in Silvercopr stock price and foreign exchange rates, quickly compressed the bid valuation to 54c. Minority shareholders were naturally displeased with SVM’s offer in addition to the company having no operating experience in Africa, so Silvercorp increased their bid by 26%, or an increase in the cash component from 15c to 19c.

Perseus Mining, a gold miner with a track record operating in Africa, quickly acquired 19.9% of shares and issued statement that they did not intend to currently make a competing bid as-is, but they were interested in the Nyanzaga mine. The miner has a A$2.4bn market cap and A$729m cash position. In 2020, Perseus similarly acquired a 15% blocking stake in gold miner Orca Gold and the 2 parties later agreed to a sale for double the original purchase price. I thought a similar series of events would ensue between SilverCorp, Perseus, and OreCorp, where the last would bid generously specially given their current strong cash reserve.

Although an aggressive bid from Perseus is still possible, a parsimonious bid from PRU convinced me to switch my capital to other more compelling opportunities. On December, 27, SVM abandoned the original scheme and made a takeover bid under the same term. Almost a month later PRU issued a competing all-cash bid for c55A for OreCorp. At this time the Silvercorp bid was valued at Ac52c after accounting for FX and the compressed SVM stock price.

If Perseus is intending to make a final offer at a much higher premium, why did they make such an underwhelming initial bid? I am unsure. They did not make a high-premium compelling bid that the OreCorp would quickly support. I think it is still likely there is a final bid from Perseus in the c60s per share perhaps, but the reward here has deteriorate more than the risk has improved. I believe it could still be a good place to invest some capital as other opportunities come along. However, there are other opportunities which I think are clearly compelling instead of this gray area.