Two New Ideas: LifeVantage and Summit Midstream

$LFVN is a recovering MLM company with a new valuable character on the board. $SMLP is an MLP which is up to value realization.

The format of my memos will remain short. As I joggle between classes and investing, I aim to maximize the time spend researching and learning while writing here concisely.

LifeVantage

Another invaluable synopsis:

A company which sells supplements and wellness products DTC,

a stellar operator just joined the board of directors,

a margin expansion to effectively 3x EV/EBITDA is feasible,

and has a rich path of catalysts.

LifeVantage LFVN 0.00%↑ sells supplement and wellness products through a network of distributors. Although I find their products for my personal consumption and multi-level marking distribution methods questionable, the company’s board has undergone encouraging changes which should lead to substantial improvements in governance and profitability through an expansion of margins. I believe an increase in sales is possible as well.

Although LFVN’s distributor base has shrunk 33% from its peak in FY19 to FY23 and a further 8.5% in the first two quarters of this year, their cash generation has remained at least decent. Sales have only shrunk 6.3% since the same peak year.

Regardless, the company generated all the cash shown in the chart even with bad governance and despite EBITDA margins well bellow the industry norm. All while management paid themselves dilutive stock grants and disregard shareholders in every way. It doesn’t seem like such a bad business and they seem to sell products with at least decent demand.

After a prolonged period of underperformance, investors Bradley Radoff and Dayton Judd, founder of Sudbury Capital, started a proxy campaign for seats on the board. The investors had previously engaged with the board but they had denied them seats. After the first round of their proxy battle in November of last year, the activist group failed to get any of their 3 nominations to the board. Then, last month, bizarrely, the board accepted Dayton Judd into the board.

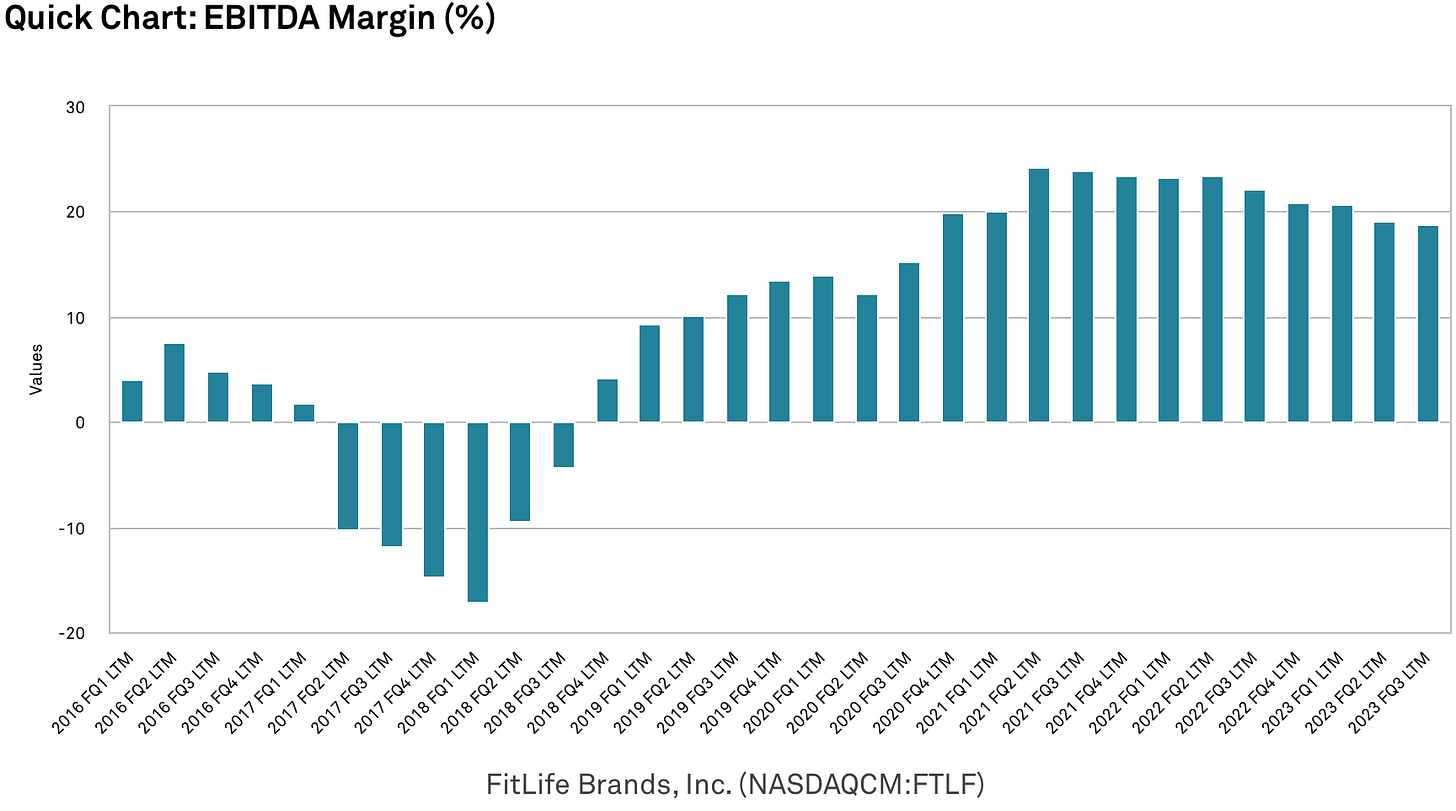

Dayton has a remarkable record as an operator. He jointed the board of another nutritional supplements company, FitLife Brands, in 2017 and later became the CEO. He saved the company from bankruptcy and now remains as the head of the company. In the meantime he has made a series of highly accretive acquisitions and improved sales and profitability significantly. Unlike LifeVantage, FTLF 0.00%↑ mainly used a wholesale channel in 2018. Dayton quickly moved sales to a direct-to-consumer channel using digital platforms and improved margins drastically in the process. Needless to say Dayton is very knowledgeable about managing direct-to-consumer supplements companies.

I expect Dayton to convey a similar plan to the LifeVantage board. The company already sells DTC and 70% of their revenue comes from the United States. Most of the remaining 30% comes from Japan. Another wellness products MLM company, Nature’s Sunshine NATR 0.00%↑, has had tremendous success switching to digital channels in the United States in the recent year, specifically their own website and Amazon. In Nature’s recent earnings calls, the CEO cited multiple times the rebound in performance they are experiencing in the US after more than a year of sluggish sales due to the e-commerce strategy. I think Dayton is well aware of this and other possible changes. As such, if the company switches to selling online, I would expect growth in sales.

Comments from most recent Nature’s earning call:

I remain vigilant of the company’s declining count of distributors. For now I am comfortable as average sales per distributor has increased significantly. So, it seems that non-productive sellers have churned away. Further, the company recently implemented many changes the compensation structure of the distributors to better align incentives and improve performance as part of their LV360 plan (1).

If EBITDA margins improve to 10%, the lowest possible double digit number in line with what Dayton suggested in his letter, the stock would trade for 3x EV/EBITDA. This is too cheap. Established MLM business typically aren’t worth more than 10x EV/EBITDA. If Dayton is successfully at implementing changes, there is a clear path for the stock to do very well and trade at least close a 6 times multiple.

Dayton has followed this playbook now 4 times in the past. 2 of them ended with acquisitions after substantial improvement sin corporate and stock performance: Rlj Entertainment and Otelco Inc., the former at a 36% premium. In the remaining two occasions he is still involved with the companies and has generated enviable returns: FitLife Brands and Optex Systems. So I think Dayton will take this new board involvement as seriously as he has done in the past.

Summit Midstream Partners

SMLP owns midstream energy infrastructure assets that are located in unconventional resource basins in the continental United States. It is a busted MLP. The stock got decimated until 2020 and changed CEO in late 2019.

MLPs tend to be uninvestable for most funds and even some individuals investors. They can be tax headaches for the partners and are often overlooked and this leads mispricings.

SMLP initiated a strategic review in Oct, 2023, where they were considering the sale of some of their assets or even the whole company. As a non-US citizen, I also skipped this stock because of some tedious withholding tax rules on the gross sale of MLP stocks.

However, the earnings call and news last Friday was extremely compelling to me. A full sale or accretive transaction seems imminent!

Simply read the highlighted text bellow:

I am unsure of the value of the individual assets. I believe these tend to sell for multiples around 8x EV/EBITDA. SMLP seems cheap on that basis. I am more confident of how management described the process and the clues they gave of a potential outcome. The “late stages” of a “robust process”.

In someways this reminds of Calumet Specialty products in 2021 when management hinted about the Warburg transaction for a stake in MRL.

(Un)fortunately the big news were released today before I could post this. Still happy!

Anything worth updating on $LFVN with pullback to $6?