A Reminiscences of Host Marriott: Net Lease Office Properties $NLOP

Another short memo on a compelling opportunity.

An invaluable abridgment:

NLOP is a recently spun-off office REIT with a portfolio of passable quality,

trades at half of its liquidation value,

management expressed clear intentions to liquidate the company,

and the process already started.

Some months ago I came across a similar case with another office REIT named Franklin Street Properties, or $FSP. Although the intentions from the company to liquidate all its portfolio were apparent, the quality of their assets was subpar and problematic to say the least. To name a few deficiencies, only 72% of the office space was leased, the company barely breaks even on an AFFO basis and has significant fixed SG&A costs, and 80% of their properties are in Colorado and Texas. Furthermore Franklin Street has had to invest a lot to keep tenant paying and improve occupancy. Net Lease Office Properties ranks exceptionally well in all the these items compared to $FSP.

Brief Background

Net Lease Office Properties has a market cap of $360m. The giant W.P Carey quietly spun off their unwanted office space in early November after announcing it a month and a half before as part of a strategic plan. The perception of the transaction in the announcement was that NLOP would receive the worse quality assets from their parent company.

A repeated theme from W.P. Carey was that the parent company would free itself from its problematic and unsellable assets.

After the company began trading on Nov-6, 2023, there were selling pressures from the new shareholders as usual with spin-offs. Since then the stock has doubled and recently climbed 40% as a result of management announcing the sale of 4 properties at very compelling prices. However, I think there is still more untapped value as the company liquidates its assets and the recent transaction derisked the stock significantly. NLOP gave a strong message to the market that their properties on average shouldn’t be valued so pessimistically.

This could be mispriced for several reasons. It is a recent spin-off from a massive REIT, which was meant to contain their worst assets and an expensive debt load. It is in an industry which is being avoided by most investors after the pandemic for perhaps structural deterioration. Also, there aren’t clean financials post-spin with their new capital and cost structure.

A Company Headshot

NLOP owns 55 properties through primarily the USA and 5 in Europe and it is well diversified geographically and in industries. At a glance the company’s portfolio seems far from terrible. It has a respectable 97% occupancy rate with an unideal 5.7 year weighted average lease term, or WALT. Although not specially lengthy it is far from terrible. With 66% of $141m in annual base rent, or ABR, coming from investment grade tenants, the assets hardly seem as problematic as depicted by the former parent company and priced by the market. NLOP has also invested very little in CapEx to keep tenants arounds. I think this also speaks to the quality of their portfolio.

W.P. Carey was not as benevolent with the capital structure. The debt package was severely unadvantageous. However, if the company can retire its expensive debt as suspected, it would very accretive to NLOP shareholders.

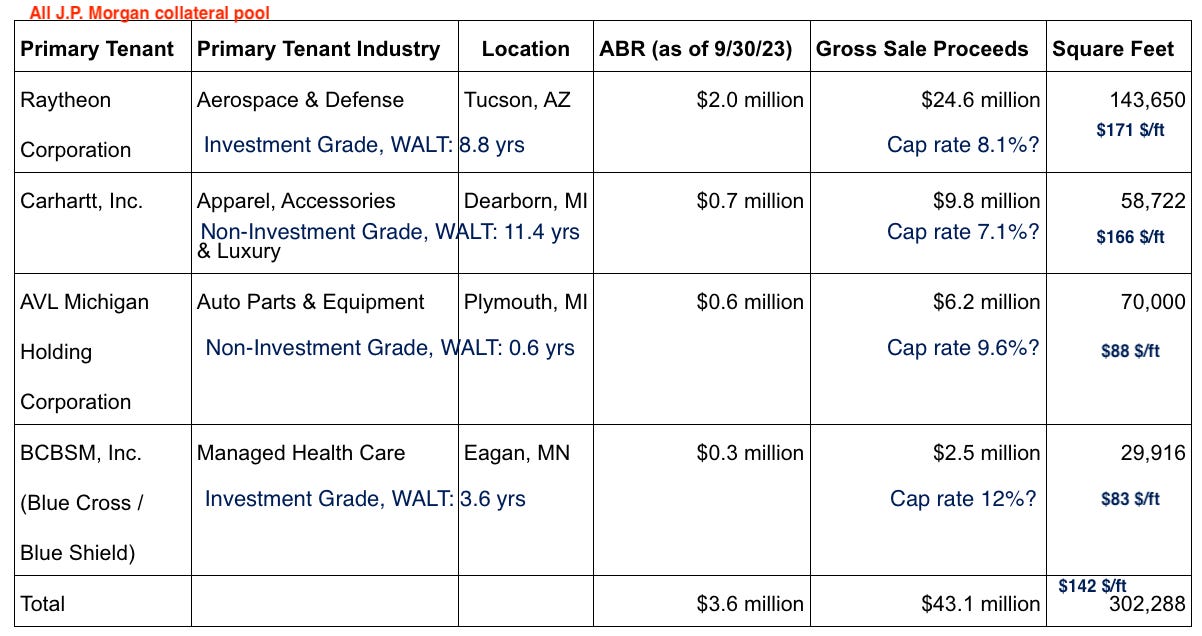

$403m J.P. Morgan Loan ($455 pre-sale of 4 properties):

$289m senior, SOFR + 5% @ 10.31%.

$114m mezanine, @ 10.00% & 4.5% PIK ($120 pre-sale of 4 properties).

$168.5 non-recourse mortgage debt.

Cash $55.6m

36 properties in the J.P. Morgan collateral pool (40 pre-sale of 4 properties). 14 properties with 11 non-recourse mortgages. 5 properties unencumbered by debt.

A Liquidation Plan

The fate of Net Lease was decided before it began trading in November. Along the strategic plan slides, W.P. Carey confirmed that NLOP would be liquidated overtime. See bellow evidence from the presentation, call, and other fillings from NLOP.

Mr. Gordon, head of asset management at WPC, also teased with the idea of strategically renewing certain expiring leases to increase property values with the final goal exiting them.

Ideal Economics for a Liquidation

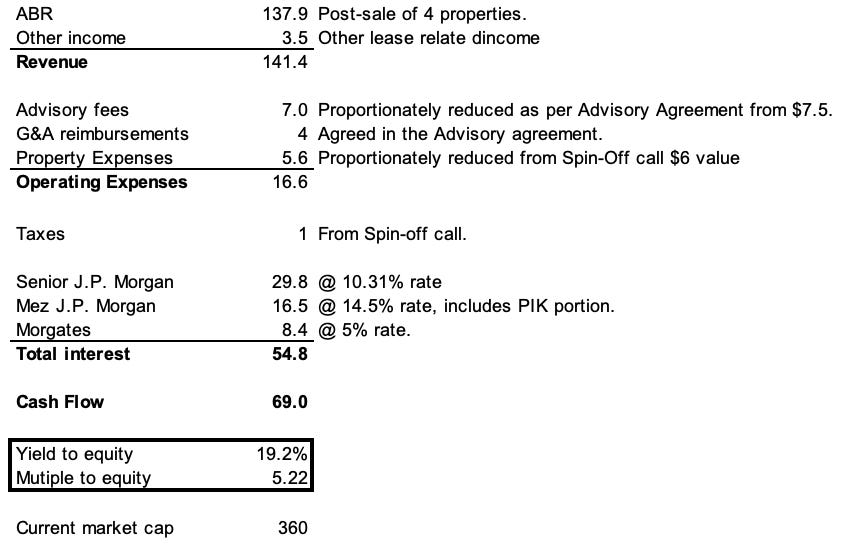

Contrary to other REIT liquidation scenarios like at FSP 0.00%↑, Net Lease has an almost entirely variable cost structure so expenses decrease as properties are sold. This feature does not compromise cash flows as the entity is liquidate and adds another layer of margin of safety as the funds generated from operations should be enough to repay the expensive debt package.

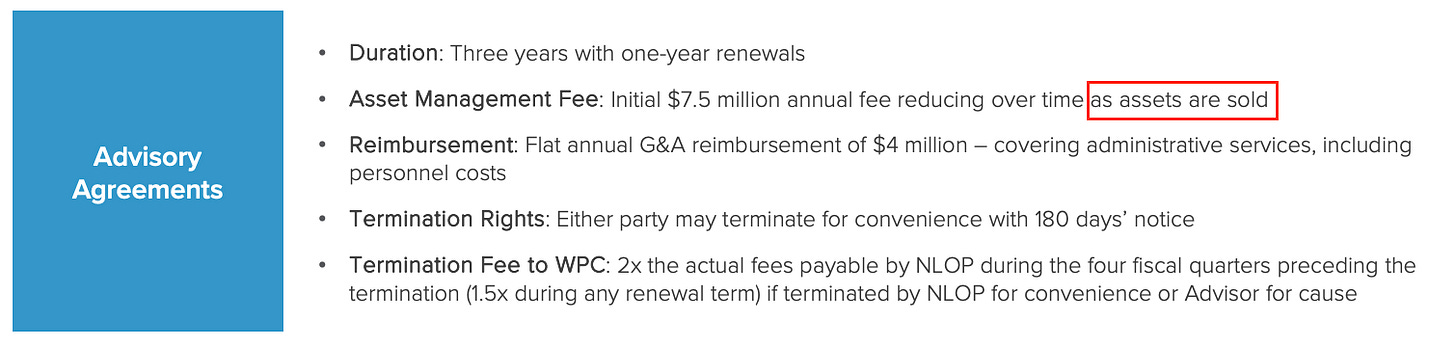

W.P. Carey and NLOP agreed on an annual management fee of $7.5m which decreases as the properties are sold in addition to $4 in G&A reimbursements. Before the transaction, NLOP contributed minimal properties expenses of $6m and $1m in taxes given the nature of their triple net leases.

Value of Portfolio

It seems evident Net Lease will return all capital to shareholders, but how much could they receive for these properties in today’s market? It is hard to know precisely what the portfolio is worth. However, today NLOP’s market cap implies extremely punitive assumptions, which I believe create a comfortable margin of safety for even the novices in real estate.

Months ago J.P. Morgan conducted a valuation of their collateral pool. They concluded on a valuation of approximately $163/sqft or a 43% LTV ratio. This implies a valuation of $1,058m for the pool. Naturally this figure should be taken carefully, but not ignored, I believe. The implied cap rate for the pool is close to 9%. The collateral pool valuation arrived by J.P. Morgan minus all recourse debt is a 68% premium to where NLOP trades these days. The premium increases to 87% by excluding the 4 properties sold from the pool and using the same implied cap rate.

The 14 properties under non-recourse mortgages also hold significant optionality value. Although one doesn’t need them to conclude Net Lease is undervalued. For these to be valueless they would need to be sold at the bleak cap rate of 15%. A conservative cap rate of 10% yields a net value increase of $70m.

NLOP wold have to exit all of their properties at a 15% cap rate to justify the current market price, which seems exceedingly pessimistic.

By segmenting the properties by WALT and applying more tailored yet still terribly depressed cap rates the stock is worth close to 30% more than where it trades today. This excludes further segmentation by investment grade and non-investment grade tenants which should increase the valuation further given most ABR comes from IG lessees. WPC also mentioned strategically renewing certain leases to achieve higher properties valuations. So some low WALTS should be converted to medium to long term duration.

I believe these assumption are still too dramatic. Using the recent property sales as a rough sketch, the portfolio should likely be sold at lower rates. The sold assets don’t seem cherry picked. Three fourths of them were non-investment grade tenants and half of them were soon-to-expire leases.

These cap rates should be more in line with reality, though still conservative. However, even if the company disposes the assets at far lower valuations, there is minimal risk of permanent capital loss. Shown differently, these simple numbers illustrate the opportunity at NLOP:

Lastly, the cash flows from operation should be immensely accretive for shareholders and also act as a catalyst as they retire extremely expensive debt. Generating $69m of cash annually and selling properties, the company should retire their debt quickly. Although the company has significant cash commitments for the mortgages for the next 2 years and a lot of cash flows should go there in the near term, which is unideal. Unless they aggressively sell their mortgaged properties soon. A 19% yield seems exaggerated.

Cherry picked Disposals

The most significant risk is if the recently sold properties are unrepresentative of their portfolio.

The table above gives a clear general picture of different prices for different quality of assess. A non-IG property with an expiring lease was sold for close to a 10% cap rate. Enticing surely. Other properties with IG and non-IG tenant but with longer WALTs were sold for cap rates around 7-8%. These hardly seem like their best assets. Although one could still argue that these were picked among the best of their kind. For example, their most valuable expiring lease with a non-IG tenant. This remains an uncertainty. However, they also own very high quality properties with long term leases to IG tenants like FedEX, CVS health, etc.

I believe the occupancy rates and little to no investments to maintain tenants and sell properties with very low WALTs also shows the quality of NLOP’s portfolio.

As previously expressed, I believe the recent sale of 4 properties de risked this situation a lot. It not only confirmed repeated signals from management to progressively liquidate the assets, but also emphasized that their office space seems to be sellable at non-distressed prices.

Other Risks

Duration risk is also present. Some properties should prove hard to sell and these and other obstacles may prolong the liquidation process. Directors are paid a generous $200,000 retainer which could incentivize a snail-pace progress. However, I think as more properties are sold at compelling valuations the stock should reprice meaningfully.

Further deterioration in the office market or a possible rise in interest rates may decrease the value of the properties as well.

Other Notes

There are trustees in the board. The three independed trustees received $100,000 in RSU as an equity grant when the company began trading. John Park, the fourth trustee, received $400,000 in NLOP stock from his stake in WPC, which he has not sold any. Jason Fox, WPC’s and NLOP’s CEO and chairman, also received more than $400,000 in stock from his stake in WPC. Their investments have doubled since NLOP began trading in November. The board of directors seems to be particularly incentivized. Another 850,000 yearly shares have been authorized for the award program.